aaaa

Lorem Ipsum is simply dummy text of the printing and typesetting industry Lorem Ipsum has been the industrys standard dummy text ever since the 1500s when an unknown printer took a galley of type and scrambled it to make a type specimen book It has survived not only five centuries but also the leap into electronic typesetting remaining essentially unchanged It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum

Lorem Ipsum new one

Where does it come from?

Contrary to popular belief, Lorem Ipsum is not simply random text. It has roots in a piece of classical Latin literature from 45 BC, making it over 2000 years old. Richard McClintock, a Latin professor at Hampden-Sydney College in Virginia, looked up one of the more obscure Latin words, consectetur, from a Lorem Ipsum passage, and going through the cites of the word in classical literature, discovered the undoubtable source. Lorem Ipsum comes from sections 1.10.32 and 1.10.33 of "de Finibus Bonorum et Malorum" (The Extremes of Good and Evil) by Cicero, written in 45 BC. This book is a treatise on the theory of ethics, very popular during the Renaissance. The first line of Lorem Ipsum, "Lorem ipsum dolor sit amet..", comes from a line in section 1.10.32.

The standard chunk of Lorem Ipsum used since the 1500s is reproduced below for those interested. Sections 1.10.32 and 1.10.33 from "de Finibus Bonorum et Malorum" by Cicero are also reproduced in their exact original form, accompanied by English versions from the 1914 translation by H. Rackham.

Lorem Ipsum 2

Where does it come from?

Contrary to popular belief, Lorem Ipsum is not simply random text. It has roots in a piece of classical Latin literature from 45 BC, making it over 2000 years old. Richard McClintock, a Latin professor at Hampden-Sydney College in Virginia, looked up one of the more obscure Latin words, consectetur, from a Lorem Ipsum passage, and going through the cites of the word in classical literature, discovered the undoubtable source. Lorem Ipsum comes from sections 1.10.32 and 1.10.33 of "de Finibus Bonorum et Malorum" (The Extremes of Good and Evil) by Cicero, written in 45 BC. This book is a treatise on the theory of ethics, very popular during the Renaissance. The first line of Lorem Ipsum, "Lorem ipsum dolor sit amet..", comes from a line in section 1.10.32.

The standard chunk of Lorem Ipsum used since the 1500s is reproduced below for those interested. Sections 1.10.32 and 1.10.33 from "de Finibus Bonorum et Malorum" by Cicero are also reproduced in their exact original form, accompanied by English versions from the 1914 translation by H. Rackham.

to add new hyperlink than

Lorem Ipsum

Where does it come from?

Contrary to popular belief, Lorem Ipsum is not simply random text. It has roots in a piece of classical Latin literature from 45 BC, making it over 2000 years old. Richard McClintock, a Latin professor at Hampden-Sydney College in Virginia, looked up one of the more obscure Latin words, consectetur, from a Lorem Ipsum passage, and going through the cites of the word in classical literature, discovered the undoubtable source. Lorem Ipsum comes from sections 1.10.32 and 1.10.33 of "de Finibus Bonorum et Malorum" (The Extremes of Good and Evil) by Cicero, written in 45 BC. This book is a treatise on the theory of ethics, very popular during the Renaissance. The first line of Lorem Ipsum, "Lorem ipsum dolor sit amet..", comes from a line in section 1.10.32.

The standard chunk of Lorem Ipsum used since the 1500s is reproduced below for those interested. Sections 1.10.32 and 1.10.33 from "de Finibus Bonorum et Malorum" by Cicero are also reproduced in their exact original form, accompanied by English versions from the 1914 translation by H. Rackham.

test

In December 2022 Spark Crowdfunding investors invested over €790,000 in Moby at a share price of €0.24. Last week, Moby raised new funds at a share price of €1.27.

This represents a 429% increase in the value of the investment in Moby since 2022. When you include the EIIS tax refund that most Spark investors would have received with this investment, it actually translates into a 780% increase in the value of the investment.

Further information about this is contained in this article by Caoimhe Gordon in the Irish Independent: https://www.independent.ie/business/irish/moby-bikes-raises-4m-for-central-europe-push-42423621.html

______________________

Moby Bikes raises €4m for Central Europe push

by: Caoimhe Gordon

April 07 2023 02:00 PM

Irish company Moby Bikes has raised €4m in funding as it plots further international expansion.

The business, which first launched in Dublin in early 2020, now has operational bases in the UK, the Netherlands and the USA.

It currently has a fleet of over 4,000 e-bikes, e-cargo bikes and electric assisted vehicles.

Moby provides bike sharing schemes in Dublin, Athlone, Mullingar and Tullamore, as well as e-bikes for food delivery drivers, an initiative introduced over the pandemic. It has also developed an electric city bike monthly subscription scheme.

Moby also works with businesses, running a bike sharing scheme at Eastpoint Business Park in Dublin. And it operates ESB e-bikes in a number of locations around the city.

The new funding will be used to accelerate the company’s growth across central Europe, particularly in the areas of last-mile delivery, corporate markets and hotels.

The company reported that it has recently increased the headcount of its local management and sales teams in this region. Moby said new investment will see it expand its bike sharing schemes in Ireland, in locations where it is “profitable to do so”.

New technology, which will focus on app-less rental and new charging opportunities for customers, is a further focus for the group this year.

“This funding is indicative of the investor confidence in our success to date and the large market opportunity we have as city transportation habits continue to shift towards electric bikes,” founder and chief executive Thomas O’Connell said. “Today we are one of the few micro-mobility companies in the world that are actually profitable,” he added.

The funding round was led by Selenean Capital, with participation from Irish investors including Brian Caulfield.

“As the world continues to prioritise sustainable transportation, Moby is well-positioned to lead the charge with their innovative technology and dedication to providing reliable, eco-friendly solutions to businesses,” Selenean Capital chief executive Davin Browne said.

This investment follows a previous €1.2m seed round which took place in late 2020.

At the time, Moby raised €800,000 via Spark Crowdfundinging, as well as a combination of debt and asset finance alongside some individual investors.

Spark investors record 429% incre...

In December 2022 Spark Crowdfunding investors invested over €790,000 in Moby at a share price of €0.24. Last week, Moby raised new funds at a share price of €1.27.

This represents a 429% increase in the value of the investment in Moby since 2022. When you include the EIIS tax refund that most Spark investors would have received with this investment, it actually translates into a 780% increase in the value of the investment.

Further information about this is contained in this article by Caoimhe Gordon in the Irish Independent: https://www.independent.ie/business/irish/moby-bikes-raises-4m-for-central-europe-push-42423621.html

______________________

Moby Bikes raises €4m for Central Europe push

by: Caoimhe Gordon

April 07 2023 02:00 PM

Irish company Moby Bikes has raised €4m in funding as it plots further international expansion.

The business, which first launched in Dublin in early 2020, now has operational bases in the UK, the Netherlands and the USA.

It currently has a fleet of over 4,000 e-bikes, e-cargo bikes and electric assisted vehicles.

Moby provides bike sharing schemes in Dublin, Athlone, Mullingar and Tullamore, as well as e-bikes for food delivery drivers, an initiative introduced over the pandemic. It has also developed an electric city bike monthly subscription scheme.

Moby also works with businesses, running a bike sharing scheme at Eastpoint Business Park in Dublin. And it operates ESB e-bikes in a number of locations around the city.

The new funding will be used to accelerate the company’s growth across central Europe, particularly in the areas of last-mile delivery, corporate markets and hotels.

The company reported that it has recently increased the headcount of its local management and sales teams in this region. Moby said new investment will see it expand its bike sharing schemes in Ireland, in locations where it is “profitable to do so”.

New technology, which will focus on app-less rental and new charging opportunities for customers, is a further focus for the group this year.

“This funding is indicative of the investor confidence in our success to date and the large market opportunity we have as city transportation habits continue to shift towards electric bikes,” founder and chief executive Thomas O’Connell said. “Today we are one of the few micro-mobility companies in the world that are actually profitable,” he added.

The funding round was led by Selenean Capital, with participation from Irish investors including Brian Caulfield.

“As the world continues to prioritise sustainable transportation, Moby is well-positioned to lead the charge with their innovative technology and dedication to providing reliable, eco-friendly solutions to businesses,” Selenean Capital chief executive Davin Browne said.

This investment follows a previous €1.2m seed round which took place in late 2020.

At the time, Moby raised €800,000 via Spark Crowdfundinging, as well as a combination of debt and asset finance alongside some individual investors.

10% Share Bonus Offer – Explana...

The 10% Share Bonus Offer rewards the first 25 investors in a new equity crowdfunding campaign with bonus shares in the company raising funds.

For example, if you decide to invest €1,000 in Altach BioMedical and their share price is (say) €4 you would ordinarily receive 250 shares.

With the 10% Share Bonus Offer, you would receive an additional 25 shares at no cost to you.

In total therefore, you would receive 275 shares for your investment of €1,000.

The maximum ‘value’ of the bonus shares per investor is €500. To receive this maximum of €500 you would need to invest €5,000, and any amount above €5,000 you invest would not qualify for any additional bonus shares.

The following Terms & Conditions apply to this 10% Bonus Offer:

Terms and Conditions - Investor Bonus Shares Offer

These terms and conditions ("Terms") apply to the Investor Bonus Shares Offer ("Offer") provided by Slua Ventures, t/a Spark Crowdfunding, a private entity incorporated under the laws of the Republic of Ireland.

1. Eligibility:

- The Offer is open to private investors aged 18 years and above.

2. Offer Period:

- The Offer is valid from 1st April 2024 to 31st July 2024.

3. Bonus Shares Calculation:

- Investors participating in the Offer will receive a bonus equal to 10% of the invested amount in the form of additional shares.

- The bonus shares will be calculated based on the total investment amount during the Offer Period.

4. Investment Limits:

- The minimum investment amount to qualify for the Offer is €100.

- There is no maximum limit for the investment amount eligible for the bonus shares, but the maximum bonus amount per investor is €500 worth of shares.

5. Bonus Shares Allocation:

- Bonus shares will be allocated within 14 days after the completion of the Offer Period.

- The allocation will be based on the closing date valuation of the company.

6. Company Eligibility:

- Bonus shares may only be issued in the same company in which the investment was made.

7. Rights and Restrictions:

- Bonus shares carry the same rights and restrictions as regular shares issued by the company.

- Investors will have the right to dividends and voting rights associated with the bonus shares.

8. Refund Policy:

- All investments made during the Offer Period are final, and no refunds will be issued.

9. Offer Amendments:

- Spark Crowdfunding reserves the right to amend or terminate the Offer at any time without prior notice.

10. Governing Law:

- These Terms are governed by the laws of the Republic of Ireland, and any disputes will be subject to the exclusive jurisdiction of the courts in the Republic of Ireland.

11. Acceptance of Terms:

- By participating in the Offer, investors agree to be bound by these Terms and any additional terms and conditions provided by Spark Crowdfunding.

12. Contact Information:

- For inquiries or assistance related to the Offer, please contact Karl McLaughlin at karl@sparkcrowdfunding.com

Spark Investors Celebrate 88% Inc...

Equity crowdfunding enables small and medium-sized investors to buy shares in early-stage companies on the same terms as large Venture Capital or Private Equity firms. Gone are the days when private investors needed to have a minimum of €500,000 before they could get access to start-ups with high growth potential.

With Spark Crowdfunding, Ireland’s only equity crowdfunding service, Irish investors can invest from as little as €100 in Irish start-ups. While this low entry level of just €100 makes these investment opportunities accessible to almost everyone, the average investment amount made by an investor on the Spark Crowdfunding platform is actually €2,300.

Most of these investment opportunities are what’s known as EIIS qualifying, which means Irish Taxpayers can recover 40% of the amount they invest as part of their tax returns. So, for example, if you invested €1,000 in one of these companies, you would receive a Tax Rebate the following year of €400, regardless of how the investment performs. In effect, this means that the maximum you can lose is 60% of your investment.

Click here if you would like to join over 8,000 Irish investors and get access to investment opportunities like these: https://www.sparkcrowdfunding.com/register

Busterbox raises new funds at an 88% increase on last year’s valuation

One such investment opportunity on the Spark Crowdfunding platform in the Summer of 2020 offered investors shares in a Dublin-based company called Busterbox, which is a Dog Subscription Box service. Every month, thousands of dog owners pay approximately €20 to have a box containing treats for their dog delivered directly to their house. The business was growing rapidly before Covid but experienced a boom in activity when more people were spending time at home with their pets.

Busterbox raised funds from 82 Irish investors on the Spark Crowdfunding platform in September 2020 at a share price of €1. Such was the growth in the business over the next 12 months that a significant industry partner invested €250,000 in Busterbox at a share price of €1.88.

This translates into an 88% increase in the value of an investment in Busterbox just 12 months previously. But, when you include the 40% EIIS Tax Refund the return on investment over this 12 month period is significantly higher.

In simple terms, if you had invested €10,000 in Busterbox, it would really only have cost you €6,000, and the value of your investment is now worth €18,800. An increase in value from €6,000 to €18,800 is actually a 213% increase in investment. (Do the Maths!!)

What’s more, investors on the Spark Crowdfunding platform pay 0% commission when purchasing shares. There are no hidden costs and it’s free to open an account.

Over the last 3 years, Spark Crowdfunding has offered 26 investment opportunities to Irish investors.

If you are interested in signing up as an investor with Spark, click below:

2 Live EIIS Investment Opportunit...

2 Live EIIS Investment Opportunities for Irish Investors in exciting Irish Start-ups

Would you like to invest in a high-growth Irish company in which TWO leading Irish Venture Capital firms are also investing? If so, you may be interested in finding out more about ClarityCX1, which is one of 2 campaigns open for investment on this platform.

Irish investors can access 2 live investment opportunities in Irish start-ups on the Spark Crowdfunding platform. Click here to view these investment opportunities: https://www.sparkcrowdfunding.com/

Each of these carefully selected investment opportunities qualify for a 40% tax refund via the EIIS scheme designed to encourage investment in Irish early-stage ventures. This means that a €1,000 investment only costs €600 as the investor can reclaim €400 in the form of a tax refund.

Furthermore, investors pay No Commission when investing in companies on the Spark Crowdfunding platform. The minimum investment size is just €100.

Further information about these live investment opportunities may be found here:

ClarityCX1: https://www.sparkcrowdfunding.com/campaign/claritycx1

ClarityCX1 is a Customer Relations Management (CRM) software business that is targeting the Pharmaceutical and Life Sciences industries. Led by Chris Deren, who has 30+ years in this industry, the company has managed to secure investment from two leading Venture Capital firms in Dublin as part of this fundraising round. It is also hoping to secure a sizeable investment from Enterprise Ireland at this time. To view the campaign video and learn more about this investment opportunity, please click here.

Please note that only registered investors of Spark Crowdfunding may view the full details of the campaign, but it takes less than two minutes to join Spark Crowdfunding and it’s free, with no obligation to invest. Click here to join Spark Crowdfunding: https://www.sparkcrowdfunding.com/register

RedZinc: https://www.sparkcrowdfunding.com/campaign/redzinc

RedZinc’s cloud-based proprietary technology enables healthcare professionals to conduct real-time video consultations on secure next generation networks. European grants of more than €2 million have helped RedZinc invest in product development and market research. The company has some excellent reference clients and is already generating annual revenues of more than €300,000. To view the campaign video and learn more about this investment opportunity, please click here.

Please note that only registered investors of Spark Crowdfunding may view the full details of the campaign, but it takes less than two minutes to join Spark Crowdfunding and it’s free, with no obligation to invest. Click here to join Spark Crowdfunding: https://www.sparkcrowdfunding.com/register

Donegal Entrepreneur is Raising F...

Donegal Entrepreneur is Raising Funds for Global Expansion

There’s no stopping Jenni Timony from Donegal Town!

Her fast-growing and highly profitable e-commerce business, FitPink, which is focused on the lucrative leisure-wear market for women, has had a phenomenal first two years in business.

Launched in July 2019, FitPink sold €470,000 worth of goods last year and generated a Net Profit of €70,000. This year, it is on target to sell a whopping €1.3m worth of goods and make a Net Profit of €240,000.

Now, for the first time, Jenni is raising funds to accelerate the already impressive growth rates of the business. She is raising €300,000 from small to medium sized investors on the Spark Crowdfunding website and has already raised over €167,000 in the first two weeks of the campaign.

To date, the company has received over 2,000 positive product reviews on its website and has built a database of over 10,000 online customers.

This is a unique and exclusive opportunity to invest at the very early stages of a business experiencing very high growth rates and with global expansion plans.

40% TAX REFUND FOR IRISH INVESTORS

An added incentive for Irish taxpayers is the very attractive 40% Tax Refund on amounts over €250 that are invested in FitPink, due to the fact that FitPink is an EIIS qualifying company. What this means is that an investment of (say) €1,000 only costs the investor a net amount of €600 as the investor can reclaim €400 in the form of a tax refund.

FORMER ENTREPRENEUR OF THE YEAR FINALIST

The company founder, Jenni Timony, is a highly experienced entrepreneur and has previously managed the Enterprise Ireland New Frontiers Programme in the North-West of Ireland. She is also a former Finalist in the prestigious EY Irish Entrepreneur of the Year annual awards.

HOW TO FIND OUT MORE ABOUT INVESTING IN FITPINK

You can watch a short video about FitPink by clicking here: https://www.sparkcrowdfunding.com/campaign/fitpink

HOW TO INVEST IN FITPINK

58 other investors have already invested in FitPink, in amounts from €100 upwards. If you would like to invest in FitPink you need to first register as an investor on the Spark Crowdfunding website. This is free and takes less than 2 minutes. You can register by clicking the green button here: https://www.sparkcrowdfunding.com/

Once you have registered as a member, you simply click on the FitPink campaign and enter the amount you would like to invest. Investors pay no fees or commission to Spark Crowdfunding. The minimum investment amount is just €100. Amounts less than €5,000 can be paid by Debit Card. For amounts above €5,000 you will be sent a link to make the direct bank transfer through Stripe.

Please email us with any questions to: info@sparkcrowdfunding.com

EIIS tax relief – what you need...

EIIS tax relief – what you need to know as an investor

EIIS is an Irish tax relief available to individuals for investments in qualifying SME startup and growth companies.

The relief is only available where the company meets various conditions. On crowdfund platforms the companies will usually qualify but this status should be checked on their campaign page. Not all companies qualify and (for example) relief is not available for investments in construction or professional services companies.

How it works

An individual can claim a refund of up to 40% income tax back on an investment – so an investment of €10,000 can result in a tax refund of €4,000.

The EIIS is offsetable against an individual’s total income which can reduce (for example) rental income, salary and dividends. It can also reduce non routine income such as Share Options gains, termination payments and ARF distributions. It is one of the very few total income tax reliefs available.

The level of the refund depends on tax paid in a year and 40% is the maximum available, being the top rate of income tax. Personal circumstances vary and an investor should ensure they have enough taxable income in the year of investments.

The relief is only available against income tax and can not reduce USC or PRSI liabilities.

Example

Generally a single individual starts paying top rate 40% income tax at €35,300 annual income. This person would need to have annual income of at least €40,300 to receive 40% tax back on a €5,000 investment. In contrast, an individual on (say) €35,000 salary making the same €5,000 investment would receive a refund of 20% tax back.

Key conditions for an Investor

For investments made after 1 January 2021, then these are the key investor conditions:

- Investors will be taking on risk of investment failure. They should determine the suitability of EIIS based on their own personal circumstances. EIIS qualifying companies are, by their nature, high risk investments.

- An investor needs to keep the shares for at least 4 years - if they sell before the end then the relief is withdrawn. For investments above €250,000 then a 7 year holding period applies and relief is capped at €500,000 annual.

- The minimum investment is €250 but some companies can have a higher threshold for EIIS investors (generally €1,000).

- Each investor is responsible for submitting their own tax refund claim to the Irish Revenue. Details are below.

- The investor must not be connected (in accordance with a wide tax law definition) to the company. This condition can be complex and needs to be reviewed further if likely to be applicable.

- The investor needs to be resident in Ireland. In certain circumstances, a non Irish resident may qualify if they have Irish taxable income.

Making a claim for the relief

The tax refund is not automatic and needs to be claimed by the individual.

After subscribing for shares, an investor has to wait until the company sends them a formal “Statement of Qualification” (SOQ). This is a crucial document.

This can generally take a few months as the company needs to have spent 30% of the monies received. It is only at that point that they can submit formalities to Irish Revenue, which will ultimately enable them to issue the SOQ to each investor.

It is only when an individual receives the SOQ that they can make a claim to Revenue for the refund.

Accelerating the refund

Tax returns can only be submitted after the end of the calendar year but an individual can inform Revenue sooner of the EIIS investment. This can only be done once the SOQ is received. Once Revenue are informed and SOQ details submitted, they may accelerate a tax refund by (for example) adjusting an individual’s tax credits so they receive higher net take home pay.

For this facility, application should be made to Revenue directly here on Myenquiries facility on the Myaccount portal. Attached are the drop down menus to use.

Image1

Submitting the SOQ via the mechanism above is not obligatory and the only advantage is that Revenue may issue the refund sooner that if you wait to submit a formal tax return.

Formal tax return

In all scenarios, an individual will still need to complete details of the EIIS investment in a formal annual income tax return. As noted, this can only be submitted after the end of the calendar year.

For most individuals in receipt of salary (PAYE) income, then the tax return obligation can be satisfied with a Form 12 which can be completed via the ‘myaccount’ portal on the Revenue website. Otherwise they need to file a formal Irish tax return (Form 11) via Revenue Online Service (ROS). If you don’t already have a Form 11 filing obligation then the EIIS investment should not, in itself, bring you within the scope of the “Form 11” process.

Generally the EIIS claim via the tax return should be made within two years of the end of year of investment.

Boxes to complete:

This is extract from the 2020 Form 12 tax return, showing the relevant panel box 66.

We have completed the boxes for an investment of €10,000 in a qualifying company, ABC Limited.

Image 2

Other points to watch

- The 40% tax relief is obtained in the year the shares issue so it should not matter when the SOQ issues. For example if the SOQ is sent to investors in 2022 in relation to shares which issued in 2021 then the tax relief would still be available in 2021.

- Loss relief is not available on EIIS shares. This means that a loss suffered would not be able to offset other capital gains.

The particular tax treatment contained herein is based on our understanding of law and current Revenue practice as at May 2021. Please note that the tax treatment depends on the individual circumstances of each client and may be subject to change in the future. You should take such independent tax advice as you deem appropriate.

This information has been provided for discussion purposes only. It is not advice and does not take into account the investment needs and objectives, financial position, risk attitude, liquidity needs, capital security needs and / or capacity for loss of any particular person. It should not be relied upon to make investment decisions.

Written by Maura Ginty

For more information, contact Gintax tax advisers maura@gintax.ie for a consult.

ASX and Esports Technologies (EBE...

ASX and Esports Technologies (EBET) join forces in strategic esports alliance

14th June, 2021 – The American SportZ Exchange (ASX), the world’s first virtual sports-trading exchange, has announced its latest strategic alliance with Esports Technologies, Inc. (Nasdaq: EBET), a leading provider of esports wagering products and associated technologies.

The alliance considers both entities joining forces in a tactical alliance that commits to bringing ASX players higher liquidity and bridging the cross-vertical divide between the esports markets and the exchange betting model. The intended result is to increase margins and improve retention opportunities in one of the gaming and entertainment industry’s fastest-growing verticals.

In the wake of the pandemic and an uncertain timetable of international sport, esports has been one of the few verticals able to maintain a robust and regular schedule of events, delivering an opportunity for millions of fans to enjoy a deeper engagement in esports, wherever they are in the world.

This fragmented global calendar for live sports has also accelerated the rise of esports as a popular betting medium, as more and more players pivoted their attention and enthusiasm to relatable esports content which fosters a familiar environment and comparable excitement. And despite the return of traditional sports from the sidelines in 2021, esports audiences have largely remained intact with fan engagement continuing growth momentum.

Through this complementary association, best-in-breed esports data from Esports Technologies (both pre-game and in-play) is intended to create a new level in authentic live engagement and peer-to-peer predictions for customers and data consumers on the ASX platform.

ASX is a hybrid next-generation fantasy sports betting company, fronted by gaming sector pioneer Paddy Power, where virtual shares in players and teams can be “traded”. This flagship startup, which allows its users to buy or sell “shares” premised on individual “player” and collective “team” performance, offers “share prices” around individual players and teams based on anticipated performance across a number of key criteria, unique to every underlying sports game.

The ASX platform is presently capitalizing on the soaring demand for esports player and team markets, whose worldwide appeal is premised on the granular statistics and player data which already drive the latest video games and fantasy football leagues across mature global markets.

Working in close collaboration with Esports Technologies, ASX seeks to promote and refine esports’ escalating popularity across worldwide regulated markets, familiarizing and educating fans via dynamic data and premium content.

Bart Barden, COO at Esports Technologies, said: “It’s great to be working with former Paddy Power leadership, aligning on an exciting shared vision for the future of esports through this strategic alliance with Paddy’s bold startup venture ASX. I’m eager to bring our collective experience to bear, unlocking the strategic synergies of these companies via this strategic alliance.

“Esports Technologies’ deep and diverse range of pre-play and in-play data can quickly attract and educate new and existing esports audiences, particularly for a US fanbase raised on DFS and consequently primed for markets that run on individual player or team statistics.”

Paddy Power, President and Co-founder at ASX, added: “Esports Technologies are trailblazers in this rapidly emerging esports domain, while Bart’s previous sterling work at a leading International betting exchange, when we overlapped at Paddy Power Betfair, earmarked him as our go-to guy for esports once this ASX opportunity presented itself. Together, we now stand at the intersection of some of the most progressive technology and untapped verticals in the industry. It’s a thrilling time to see how we might again collaborate to mutually-beneficial effect over the coming months and years.

“ASX is the next logical step in the DFS evolution, fusing the excitement of an active trading marketplace with the most immersive retention aspects of fantasy management. By combining intuitive and recognizable stock-exchange transaction mechanics with the dynamics of live sporting events and record low-latency data distribution, we are now paving the way for the next generation in esports betting and fan-engagement ecosystems.”

Notes for Editors:

About the American SportZ Exchange (ASX)

ASX is a sports and entertainment technology company. It operates at the nexus of Sports Betting, Financial Market Investment and Fantasy Games. ASX offers Sports Fans a new way to speculate on Player Performance or Team Performance. ASX is a member of the prestigious Sportradar Acceleradar Programme and was also selected out of 1,500 global sports tech startups to partner with the leading sports tech promoter HYPE to secure a range of partnerships and investors specialized in the sports and entertainment industry.

About Esports Technologies Inc.

Esports Technologies is developing ground-breaking and engaging wagering products for esports fans and bettors around the world. Esports Technologies is one of the global providers of esports product, platform and marketing solutions. The company operates a licensed online gambling platform, gogawi.com, that offers real money betting on esports events and professional sports from around the world in a secure environment. The company is developing esports predictive gaming technologies that allow distribution to both customers and business partners. For more information, visit: https://esportstechnologies.com.

Forward-Looking Statements

This press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995, which statements involve risks and uncertainties. These statements relate to future events, future expectations, plans and prospects. You can identify forward-looking statements by those that are not historical in nature, particularly those that use terminology such as “may,” “should,” “expects,” “anticipates,” “contemplates,” “estimates,” “believes,” “plans,” “projected,” “predicts,” “potential,” or “hopes” or the negative of these or similar terms. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable as of the date made, actual results or outcomes may prove to be materially different from the expectations expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to, the Company’s ability to successfully launch its free to play app. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors, including those discussed in the Company’s filings with the Securities and Exchange Commission, including as set forth in the “Risk Factors” section of the Company’s final prospectus, which was filed with the Securities and Exchange Commission on April 16, 2021, as updated by the Company’s subsequent Quarterly Reports on Form 10-Q. The Company does not undertake any obligation to release publicly any revisions to forward-looking statements as a result of subsequent events or developments, except as required by law.

How to Invest in Paddy Power’s ...

How to Invest in Paddy Power’s New Start-up ASX

Paddy Power is a name that is very familiar in business and gambling circles from his many years as Head of Communications for Paddy Power plc., later to be named Paddy Power Betfair, and eventually Flutter plc.

Flutter plc is now a FTSE 100 company, meaning it is in the top 100 publicly quoted companies in the UK. It has a market capitalisation of £27 billion – which is bigger than Ryanair, Bank of Ireland and AIB Bank combined!

After 25 very successful years at the company, Paddy Power has now set up his own venture and, unsurprisingly, has assembled a highly impressive team to work with him on this.

New Venture – ASX

His new venture is called ASX and it is a ‘Virtual stock market’ which will allow users to buy shares in players and teams based on expected performance.

ASX launched an equity crowdfunding campaign on the Spark Crowdfunding platform on 7th May 2021 to raise €500,000. The campaign was due to run for 30 days but ended after just 24 hours, at which point over €600,000 had been raised from 206 investors for an average investment amount of €3,068.

Many investors were disappointed to have missed out on this opportunity to invest.

Another Opportunity to Invest

Although ASX requires no further funding at this time, the company has decided to offer an additional allocation of between €500,000 and €1m to investors who would like to invest at this time.

Unlike the first campaign that completed on 8th May, there is no fixed share price being put on the shares for this new campaign. Instead, investments today will be converted into shares at a 25% discount to the share price when ASX does its next major fundraising exercise, which is expected to be in 12-18 months.

For example, if the ASX share price at the next fundraising is €4, investors who invest at this time will have their investment today converted into ASX shares at a price of €3 at the time of the next fundraising. A 25% discount equates to a 33% return on your investment. In other words, if you buy €1,000 worth of shares today, these shares will be valued at €1,333 at the time of the next fundraising.

Paddy Power is personally investing €50,000 in this second campaign.

Campaign is Live and Open for Investment

The campaign is now open for investment and you can watch the campaign video (and invest) here.

The campaign opened on 23rd May and within 12 hours had already raised over €500,000. The campaign will close if a maximum of €1m is reached or within 30 days.

ASX is an EIIS qualifying company, which means investors can recover 40% of the value of their investment in the form of a tax rebate, when their investment is converted into shares. For example, an investment of €1,000 would receive a Tax Rebate of €400 (Irish taxpayers only).

The minimum investment is just €100. Investors pay no commission on their investments with Spark Crowdfunding.

How to Invest

This investment opportunity is exclusive to members of the Spark Crowdfunding platform. It takes less than 3 minutes to open an account and registration is free. Click here to register.

Investments below €5,000 may be made by Debit/Credit Card. For amounts in excess of €5,000 investors will be sent a unique IBAN code. All payments are handled by Stripe.

Please contact Chris Burge at chris@sparkcrowdfunding.com if you have any questions. We’d love to hear from you.

SAFE Investment

SAFE Investment Instrument for Beginners - All You Need To Know

A SAFE stands for a “simple agreement for future equity”. The mechanism was authored by Y Combinator lawyer Carolynn Levy and open sourced. It was created and published as a simple replacement for convertible loan notes (CLNs).

A SAFE is an agreement between an investor and a company that provides rights to the investor for future equity in the company similar to a warrant, except without determining a specific price per share (or a valuation) at the time of the initial investment.

This element (no valuation) is key especially in start-ups in certain sectors where the future earnings of the company are very difficult to quantify.

In practice a SAFE enables a start-up company and an investor to accomplish the same general goal as a convertible loan note, though a SAFE is not a debt instrument.

The SAFE investor receives the future shares (typically at a discounted price) when a priced round of investment or liquidity event occurs. SAFEs are intended to provide a simpler mechanism for start-ups to seek initial funding than convertible notes.

SAFEs solve a number of issues that convertible loan notes have for start-up companies. Because SAFEs are not debt instruments, they remove the threat of insolvency that a convertible loan note can cause, and they remove the need for founders to go back to investors to request maturity date extensions (this also saves investors from having to deal with extension paperwork). Additionally, SAFEs reduce the amount of legal cost and negotiation time by simplifying the agreement relative to most convertible loan notes.

Unlike a convertible loan note, a SAFE is not a loan; it is more like a warrant. In particular, there is no interest paid and no maturity date, and therefore SAFEs are not subject to the regulations that debt may be in many jurisdictions.

While the SAFE may not be suitable for all financing situations, the terms are intended to be balanced, taking into account both the start-up’s and the investors’ interests. There is a trade-off between simplicity and comprehensiveness, so while not every edge case is addressed, it is believed the SAFE covers the most pertinent and common issues.

Invest in Companies That Enterpri...

How to Invest in Companies That Enterprise Ireland Invests In

If you are an ordinary private individual with anything from €100 to €100,000 available to invest in high growth Irish companies, how can you gain access to these types of investment opportunities?

Spark Crowdfunding has a solution.

In February 2021, Pitchbook, a leading Venture Capital (VC) and Private Equity Investment Platform, reported that Enterprise Ireland ranked first in the world of venture capital investors by deal count, a fantastic achievement by the Irish organisation.

One of the ways by which Enterprise Ireland invests in Irish Start-ups is through its High Potential Start-up programme. This programme typically sees Enterprise Ireland invest alongside other investors that the Start-Up is required to identify. In fact, it is usually a condition of the Enterprise Ireland investment that the Start-Up must bring to the table a matching amount of investment to that which Enterprise Ireland is investing.

So, for example, if Enterprise Ireland is investing €250,000, the founder of the Start-up is required to find investors also willing to invest €250,000 in the business. This is known as ‘matched funding’.

Very often, these early-stage companies do not have access to investors who can help provide this €250,000 that can unlock the €250,000 from Enterprise Ireland. There are many ways in which they can secure these funds, but, increasingly, Irish Start-ups are turning to Spark Crowdfunding to gain access to a large database of private investors who can help.

Over the past two years, 16 Enterprise Ireland funded companies have successfully raised investment funding on the Spark Crowdfunding platform, for the first time giving small and medium-sized Irish investors access to a broad variety of new and exciting investment opportunities.

But, in addition to gaining access to investment opportunities favoured by Enterprise Ireland, what are the other benefits for Irish investors that Spark Crowdfunding can offer?

7 Benefits for Irish Investors

1. Pay No Commission to Invest

Investors pay no commission when investing with Spark Crowdfunding. 100% of your investment goes into purchasing the shares. Only the company raising investment funds pays any commission.

2. Receive a 40% Tax Rebate on the Investment

Almost all of the investment opportunities on the Spark Crowdfunding platform are EIIS qualifying companies. This means that Irish investors can reclaim 40% of the value of their investment in the form of a tax refund. In other words, if you invest €1,000 in a campaign, you receive a tax rebate of €400, which means your maximum loss is €600.

3. Unlimited Upside Potential

While the EIIS tax rebate limits your loss to 60% of your investment on the downside, there is no limit to the upside potential of your investment. As an ordinary shareholder in the company you continue to benefit for as long as the share price continues to rise – there is no cap on how much you can make.

4. Small Minimum Investment amount

As part of our mission to make investment opportunities accessible to investors of all sizes, we have put a minimum investment amount of just €100 on campaigns on the Spark Crowdfunding platform. You could say we are trying to democratise Dragons’ Den!

5. Build your own Private Portfolio of Shares

With a very low minimum investment size and no commission to pay on investing, Spark Crowdfunding makes it very easy for private investors to build their own portfolio of shares across a wide variety of companies, from tech to retail and everything in between. Moreover, every company that raises funds on the Spark Crowdfunding platform is required to provide its shareholders with a Quarterly update on how the business is performing, so you will receive regular progress reports from the founders.

6. Free to Join

There are no fees to join Spark Crowdfunding, nor do we charge maintenance fees to operate an account. We don’t hold Client Funds and you only ever transfer funds when you wish to make an investment.

7. Invitations to Investor Webinars

As a valued member of Spark Crowdfunding, you will receive regular invitations to attend our Investor Webinars and ask questions of the promoters looking to raise new funds.

Join thousands of other Irish investors and get with the crowd!

If it’s good enough for the largest Venture Capitalist in the world by deal count ……………………!

Click here to join Spark Crowdfunding for free. It takes less than 2 minutes to register and receive regular notifications of new investment opportunities from as little as €100.

How the Nominee works for Spark C...

How the Nominee Structure works for Spark Crowdfunding investors

When you buy shares in a company on the Spark Crowdfunding platform, we (at Spark Crowdfunding) aggregate all of these investments into one large investment amount.

We do this for several reasons. Firstly, under Irish statute law, private companies may not have more than 149 shareholders. Crowdfunding campaigns, by their very nature, create lots of small to medium sized shareholders for a private company and the only way they can all become shareholders is if they come together as a single shareholder.

Secondly, it makes it much easier for the company raising funds on the Spark platform to raise funds at a later date (after their crowdfunding round) from (say) a Venture Capital investor if they have a relatively small number of shareholders in their company.

The cleanest, simplest and least expensive way to aggregate all shareholders from an equity crowdfunding round is to use a vehicle known as a Nominee Company.

In layman’s terms, a Nominee shareholder is one who holds shares on behalf of the actual owner (beneficial owner) under a custodial agreement.

Legal Ownership versus Beneficial Ownership

Companies that raise funds on Spark Crowdfunding use a company called Pearse Trust to manage the Nominee vehicle that holds all of the new shares that have been purchased in the crowdfunding round.

As an investor in a company whose shares are held in a Nominee company you are the beneficial shareholder in that company. The legal shareholder is Pearse Nominees Limited (PNL). PNL hold a single share certificate for all of the shares that are cumulatively held by the members of the Nominee company.

All of the individual investors have rights to a percentage of those total shares in direct proportion to the size of investment they have made in the company that raised the funds.

Pearse Trust Ltd and Pearse Trust Nominees Ltd

Pearse Trust Limited (CRO#: 111529) is a legal and company secretarial business that is based in Sandyford, Co Dublin and has operating in this specialist area since the current directors Joseph Hickey and Grainne Riordan founded the company in 1985.

Pearse Trust Nominees Limited (CRO#: 130202) was incorporated in 1988 and is the vehicle that Pease Trust uses to host its nominee structures.

Almost all of the companies that have raised funds on the Spark Crowdfunding platform use the services of Pearse Trust to manage the relationship between the new shareholders and the company that has just raised funds. It should be noted that Spark Crowdfunding is not a party to the Nominee arrangements and plays no role in the relationship between Pearse Trust and the company that has just raised the funds and its new investors. However, we are available to answer any questions that an investor may have about how a Nominee vehicle operates.

Role of Pearse Trust

Once an equity crowdfunding campaign has finished on the Spark Crowdfunding platform, legal agreements are prepared to protect the new investors. A company that retains Pearse Trust to manage the shareholder arrangements will instruct Pearse Trust to email all of the new investors with information about the crowdfunding campaign and a copy of the legal agreement that governs their investment. Pearse Trust then gathers all of the signatures from the new investors, confirming their intention to proceed with the investment.

From that point on, all shareholder communications from the company that has raised the funds will come from Pearse Trust, as the Nominees. The Nominee is structured so that not all members need to vote, and of those who do, 50% of the shareholding + 1 share will decide the result of the resolution. The whole block in the Nominee will then vote accordingly.

Being a part of a nominee does not dilute your rights as a shareholder in any way. Your rights as a shareholder are exactly the same as if you held the shares in your own name on the Shareholder register.

Please contact us if you have any questions about this.

Should I Invest in a Crowdfunding...

Investor Checklist – Should I Invest in a Crowdfunding Campaign or Not?

If you are thinking of investing in an equity crowdfunding campaign on Spark Crowdfunding but don’t know what factors you should take into consideration, we have prepared a checklist of ten things you should consider.

We would caution against an investment unless it ticks most or all of these boxes:

1. The Business Model

Is the business scalable? A scalable business is one that can increase profits over time, by growing revenue while avoiding cost increases. Another way to describe a scalable business is one which can serve an increasing number of customers without having to increase its costs as a result. For example, a company that sells software can sell the exact same software to many customers, without increasing its costs by much. A hairdresser, on the other hand, is limited by the amount of hours she works and can therefore only serve a limited number of customers. Scalable businesses have the potential to grow much faster and therefore deliver a higher return for investors.

2. Size of the Market

How large is the market that the company is targeting? You don’t need to know to the exact penny how big the market for a particular product is, but you should be able to make a good, educated guess as to whether it is big enough to allow the company to achieve its Sales targets. Factor in the level of competition, both actual and potential.

3. Intellectual Property (IP)

Does the company have any IP, such as a Patent, that can protect it from new entrants to the market? Patents are extremely difficult and expensive to get, and most successful companies have no patents, so this factor should not be a deal breaker, but look for quasi forms of protection, such as a large database of users or a strong brand.

4. Company Achievements to Date

Companies raising funds on Spark Crowdfunding tend to be at an early stage in their evolution, but before they raise funds, they should be able to point to some level of achievement. This could be anything from a successful pilot exercise with a Minimum Viable Product to a signed contract from a paying customer. Another achievement could be in the form of third-party validation from Enterprise Ireland through participation in its High Potential Start-Up (HPSU) programme.

5. Quality of the Management Team and Previous Successes they have had

Does the Management Team have the skills, knowledge, attitude and aptitude to successfully execute the Business Plan? What have they done in previous jobs or with previous companies to support this? Don’t necessarily rule out someone who has had a previous business failure. Every failure is a victory if you learn from it.

6. Use of Funds

To what use are the new funds being put? Funds being used to increase bottom line profits are generally preferable to funds being deployed to build an infrastructure that only then starts to increase bottom line profits. Related to this is whether the amount being raised is sufficient to enable the company to deliver on its plans or whether it will need to raise funds again. There is always a risk that a company may not be able to raise funds the next time.

7. Timeframe

How long is it likely to take for the company to execute its business plan and what risks are associated with this? Related, what is the likely timeframe for investors to get an exit and what form is that exit likely to take – trade sale or flotation?

8. Company Valuation

Valuing early stage companies is difficult. A basic question to ask is “Am I likely to get a minimum of 3 times my investment back and ideally five times my investment?”

9. Tax Breaks Available

Can I get a tax refund on my investment? In Ireland, many companies qualify for the EIIS Scheme, which means investors in these companies can receive an immediate tax refund of 40% of the amount they invest. So, if you invest €1,000 in a company, you get an immediate tax rebate of €400. In effect, you are investing in the company at a 40% discount, which has a substantial impact on your net return.

Here are two articles we have written about the EIIS Scheme:

https://www.sparkcrowdfunding.com/blog/beginners-guide-to-the-eiis-scheme-for-irish-investors

https://www.sparkcrowdfunding.com/blog/how-awesome-is-the-eiis-scheme-for-irish-investors

10. Who else is investing?

It’s always useful to see who else is investing in a campaign. You can easily check this by looking at the campaign page on the Spark Crowdfunding website. You can also join one of the Investor Clubs operated by Spark Crowdfunding by clicking here: https://www.sparkcrowdfunding.com/investor_club/

HOW TO JOIN SPARK CROWDFUNDING

If you’d like to join thousands of Irish Investors and get exclusive access to investment opportunities in some of the leading Irish start-ups, click here to join Spark Crowdfunding: https://www.sparkcrowdfunding.com/register

It’s free to join and only take a few minutes to register your profile.

Join Thousands of Irish Investors...

Join Thousands of Irish Investors getting exclusive access to exciting Irish Startups

In May 2010, a private Startup run by two Irish brothers was valued at $2 million. They couldn’t find investors in Ireland and so they raised funds in the US. In April 2020 this company was valued at $36 billion. If you had invested $1,000 in 2010, it would be worth $18,000,000 today.

The name of the company is Stripe and it was founded by John and Patrick Collison from Limerick.

Back in 2010, there was no platform through which Stripe could allow Irish investors to buy shares in companies like Stripe. Today, there is – Spark Crowdfunding.

It is the only company in Ireland that offers equity crowdfunding and anyone with €100 to invest can join.

Dragons’ Den for Ordinary Investors

Equity crowdfunding gives private investors access to investment opportunities that were once only accessible to large Venture Capital firms.

Think of equity crowdfunding as an online version of Dragons’ Den, where ordinary investors can become the Dragon. When enough of these Dragons invest together, they become a ‘crowd’ and the crowd buys shares (or equity) in a private company as a group.

Spark Crowdfunding

Established in Dublin in 2018, Spark Crowdfunding is simply an online platform that connects private Irish companies seeking to raise funds with ordinary Irish individuals who are interested in investing in Irish start-ups.

The process is very straightforward. A company uploads a campaign to the platform, which includes a video and a description of the business. Investors make a decision on whether they wish to invest in the company or not - and can invest anything for €100 to €100,000. The average investment size is roughly €2,000.

Investors on the Spark Crowdfunding platform have invested in 14 Irish start-ups over the past two years, in amounts ranging from €50,000 to €560,000. Many of these companies have also been funded by Enterprise Ireland.

Case Study – Success Story

In December 2018, a car hire app called Fleet raised €384,000 from 132 investors on the Spark Crowdfunding platform at a valuation of €1 million. The value of Fleet increased over the following 15 months, and in March 2020 Fleet raised more money at a valuation almost three times higher than the valuation at which the Spark Crowdfunding investors purchased their shares. And this doesn’t even include the 40% tax refund the Irish investors received on their investment.

Generous Tax Refunds for Investing in Irish Start-ups

Investors who invest in most of the Start-ups on the Spark Crowdfunding platform can receive very generous tax breaks on their investments. Specifically, investors can receive a 40% refund on investments in companies that are EIIS approved. Therefore, a €1,000 investment would receive a tax refund of €400, regardless of how well the company performs. Further information about this may be found in this article: https://www.sparkcrowdfunding.com/blog/beginners-guide-to-the-eiis-scheme-for-irish-investors

How to Join the Crowd and Invest in Exciting Irish Start-ups

To access these investment opportunities, it is necessary to register as a member of the Spark Crowdfunding platform. It’s free to join and there is no obligation to invest. Click here whenever you are ready to join: https://www.sparkcrowdfunding.com/register

Perhaps your first investment could turn out to be the next Stripe!!

Beginners Guide to the EIIS Schem...

EIIS stands for Employee and Investment Incentive Scheme. The purpose of the scheme is to encourage private individuals in Ireland to invest in Irish private companies in order to help these companies grow and create new jobs.

The way in which the EIIS incentivises Irish investors to invest in these companies is by offering the investor a tax refund of 40% of the amount of their investment, on the basis that the investor leaves the investment in the company for a minimum of 4 years.

Therefore, if you, as an Investor, invest €10,000 in company ABC, you can reclaim €4,000 of this €10,000 from the Irish Revenue Commissioners when you make your tax returns for the year in which you make the investment.

The effect of this is that the most you can lose on this €10,000 investment is €6,000, and even if your investment provides you with a big payback, you still keep the €4,000 tax rebate. This makes a major difference to the risk-reward trade-off of the investment.

It should be noted that the Irish Revenue Commissioners do not deem all companies eligible for EIIS status, so the tax rebate does not apply to companies in every sector.

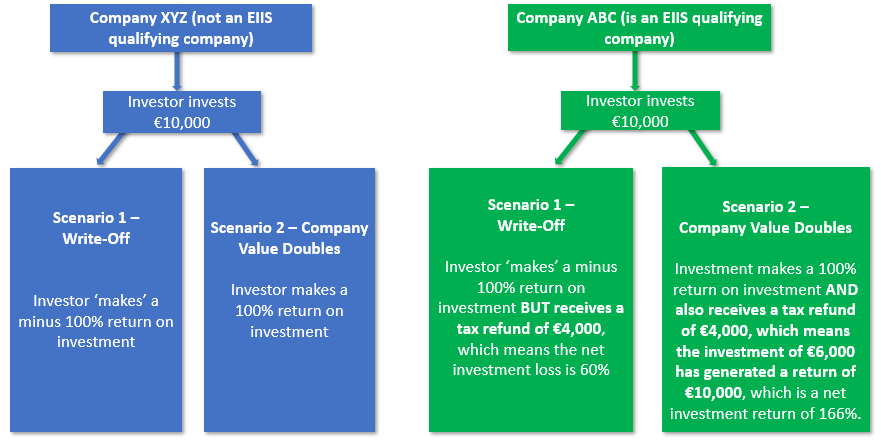

Investment Scenarios

Let’s take a look at a couple of investment scenarios, the first of which applies to a company that does not qualify for an EIIS tax refund and we then contrast the potential returns from this with a company that is an EIIS qualifying company. In each scenario, the company could return either nothing to the investor (i.e. a write-off) or the company could double in value (i.e. a 100% increase in value).

The difference between a return of 100% and 166% may not sound like an awful lot, as per the difference in investing in an EIIS qualified company and a non-EIIS qualified company in the examples above.

However, if you compound this over just 5 investments, a €10,000 investment in 5 non-EIIS companies delivers a return of €320,000, whereas an investment of €10,000 in 5 EIIS qualified companies delivers a return of €426,000, which highlights the advantages of investing in EIIS companies.

Most of the companies that raise funds on Spark Crowdfunding are EIIS approved companies. To receive regular notifications of EIIS investment opportunities straight to your inbox please register on the Spark Crowdfunding site for free by clicking below.

Leveling the playing field for Ir...

Imagine if Amazon had raised funds by doing an equity crowdfunding campaign shortly after they launched back in 1998 when their valuation was about €1m. Anyone who had invested just €1 in Amazon back then would have an investment today worth about €871,000 today.

The average investment amount in an equity crowdfunding campaign is €1,500, so an average investment in Amazon back in 1998 would be worth about €1.3 billion today!

Unfortunately, the average investor, like you or I, couldn’t invest €1,500 in Amazon back in 1998 because crowdfunding platforms, like Spark Crowdfunding, did not exist. Hence, it was only the Venture Capitalists who earned these massive returns on investments in startups like Amazon.

Does that sound fair to you? Is that a level playing field when it comes to investing in startups?

Democratising Finance

Equity crowdfunding platforms provide small and medium sized investors with access to exciting early stage companies, like Amazon. Essentially, these platforms make it as easy for a small investor with €100 to invest in a startup as it is for a venture capitalist with €1m to invest. This is what is known as ‘democratising’ finance and it partly explains why equity crowdfunding has become so popular over the last 6 years.

Where Dragons’ Den enables just 5 investors to invest in a startup, equity crowdfunding opens it up to the wider investor community and allows thousands of investors to invest in an early stage business. Equity crowdfunding is simply an online version of Dragons’ Den.

The Importance of the Crowd

Assessing investment opportunities can be a challenge at the best of times. How realistic is the company valuation, how good is the management team and how big is the demand for the product are just some of the questions an investor will ask. It is very difficult for any one individual to take all of these factors into account and make an informed decision. This is where the crowd can help.

In his excellent book ‘The Wisdom of Crowds’, James Surowiecki provides may examples showing that “a diverse collection of independently deciding individuals is likely to make certain types of decisions and predictions better than individuals or even experts”. Equity crowdfunding platforms provide the ideal vehicle for this, in two ways.

Firstly, investors can engage directly with company promoters and ask questions about the history or plans of the company, with the answers to these questions on show for all members of the platform. Second, and more importantly, investors can see exactly how much money other investors have pledged to invest in the crowdfunding campaign and use this information as a ‘signalling’ mechanism. If no-one is investing in a campaign it is a good sign that you should ask more questions before making your own investment decision.

Building a Portfolio of Small Investments

For every €1.3 billion investment opportunity like Amazon, discussed above, there are thousands of startups that go bust or return very little to the investors. That’s the nature of startup investing. Even Venture Capital firms get it wrong more times than they get it right. But the reason many Venture Capitalists succeed is because they spread their investments across a wide portfolio of investments. In general, for every 10 startup investments they make, six of them will be a write-off, another two will return the original investment and the last two will achieve the high multiples which will generate the required returns for the portfolio. This is precisely the type of investment approach that small investors should adopt and equity crowdfunding platforms, like Spark Crowdfunding, now make this possible.

Generous tax breaks from the EIIS Scheme for Irish taxpayers also reduce the risk by giving investors a 40% tax rebate on investments in Irish startups. Please contact us for more information about this.

Test the Water First

As with all types on investment, it is advisable to fully understand the risks before taking any action. We would recommend that investors fully familiarise themselves with all of the features of equity crowdfunding and also investing in early stage business, and even then, test the water by starting with a very small amount of money.

With the minimum investment amount of just €100 per campaign on the Spark Crowdfunding platform, a small investor can now build a portfolio of startup investments with as little as €1,000, and there are no hidden costs or fees for investors.

You don’t want to miss out on the next Amazon!!

Click here to view the latest campaigns or to open an Account for free

How Awesome is the EIIS Scheme fo...

How Awesome is the EIIS Scheme for Irish Investors?

“If you invest €10,000 in that company, you will receive €4,000 back in the form of a tax rebate, so you’re actually buying €10,000 worth of shares for €6,000. In other words, you can buy those shares at a 40% discount.”

That’s how the conversation started.

I was aware that the Government had some incentive scheme to encourage investors to buy shares in private companies, but I didn’t realise it was that good!!

“Are you serious? There is surely a catch somewhere”, I retorted.

“There’s no catch, although you only get €3,000 back from the Revenue in the first year, and only if you hold onto the shares for 4 years will you receive the final €1,000. The only other requirement is that the Company you are investing in has been approved by the Revenue to participate in this Scheme”, he said.

This scheme is known as the Employment and Investment Incentive Scheme, or EIIS for short.

As the name suggests, it was designed by the Irish Government to encourage investors to invest in small and medium sized Irish companies, which are basically the life blood of the country.

The best way to explain it is with an example.

Example of the EIIS in action

Fleet is an Irish person to person car sharing app which connects people who want to rent out their car with people who are looking to rent a car.

Fleet has been approved by the Revenue Commissioners in Ireland as an EIIS qualifying company, by virtue of its trading activities.

Fleet is raising €275,000 in return for 20% of the company on the Spark Crowdfunding platform.

An investor decides to invest €5,000 in Fleet.

Assuming the investor pays Income Tax in Ireland, he/she will be immediately entitled to a refund of €1,500 (i.e. 30% of €5,000) from the Revenue for making this investment.

If the investor holds the shares for 4 years, then they can reclaim an additional €500 (i.e. 10%) from the Revenue in that year.

What is the Net Effect of this?

Essentially, the investor is purchasing the shares at a 40% discount to the company valuation.

This is a very appealing tax benefit to investing in companies on the Spark Crowdfunding platform. Further information on the EIIS Scheme may be found in this Guide from the Revenue Commissioners.

If you are interested in signing up as an investor with Spark or would like to know more about raising funds for your business, please click on either of the buttons below:

How to Invest with the Crowd in I...

Fancy yourself as a bit of a Dragon? We all do!

But getting access to attractive deals is impossible and you probably don’t want to invest as much as the average Dragon. And it would be nice to able to take some comfort from knowing what other investors like yourself think of the investment opportunity.

Equity crowdfunding gives small to medium sized investors access to the types of deals only previously accessible to Venture Capital companies (or Dragons!). The crowdfunding industry has exploded in popularity in the UK, USA and Australia as a simple, quick and low-cost way for startups to secure venture funding.

We didn’t invent equity crowdfunding here at Spark Crowdfunding, but we were the first company to introduce it to the Irish market in mid-2018. Since then, our investors have invested €384,000 in Fleet, the person to person Car Sharing App; €284,000 in Campsited, the Airbnb for campsites; and €147,000 in Wellola, a med-tech video consultation app. Interestingly, all three of these companies are also Enterprise Ireland High Potential Startup companies.

The minimum investment amount in each of these campaigns was €100 and this was designed to appeal to as many small and medium sized investors as possible. This did not prevent larger investors participating also and each campaign had investors who invested €25,000 or more.

Tax Rebate for Irish Investors in Irish Startups

Irish investors can also claim a tax rebate of 40% of the value of their investment in many of these startups with EIIS (Employment and Investment Incentive Scheme) status. What this means is that an Irish taxpayer who invests €1,000 in one of these companies can reclaim €400 in the form of a tax rebate (€300 in year 1 and €100 in year 4). This reduces the risk or maximum loss of a €1,000 investment to €600. Please contact us for more information on EIIS.

Benefits of Joining Spark Crowdfunding

If you are a small to medium sized investor interested in hearing about new investment opportunities in exciting Irish startups, where the minimum investment amount is typically €100 and where you can actively monitor the amount invested as each campaign evolves and discuss the merits of the investment opportunity with investors like yourself, then Spark Crowdfunding could be for you.

How to Join the Crowd

Registration is free and only takes a couple of minutes. New members must answer a number of questions to ensure they fully understand the risks of investing in startups. Click here to register now. Investors are under no obligation to invest in any campaign and, as we don’t hold investor funds, no deposit is required until a campaign completes.

Spark Crowdfunding – Democratising the way in which Irish investors can invest in Irish startups.

If you are interested in signing up as an investor with Spark or would like to know more about raising funds for your business, please click on either of the buttons below:

Risk Warning – Investing in Startups is high risk and investors could lose the full value of their investment. Investors should only invest with money they can afford to lose. We recommend all investors seek independent financial advice before proceeding with any investment.